Services

- Pre-Funding Reports

- Monthly Monitoring Reports

- Tax Consulting Services

Pre-funding Reports

See tax problems before you fund.

-

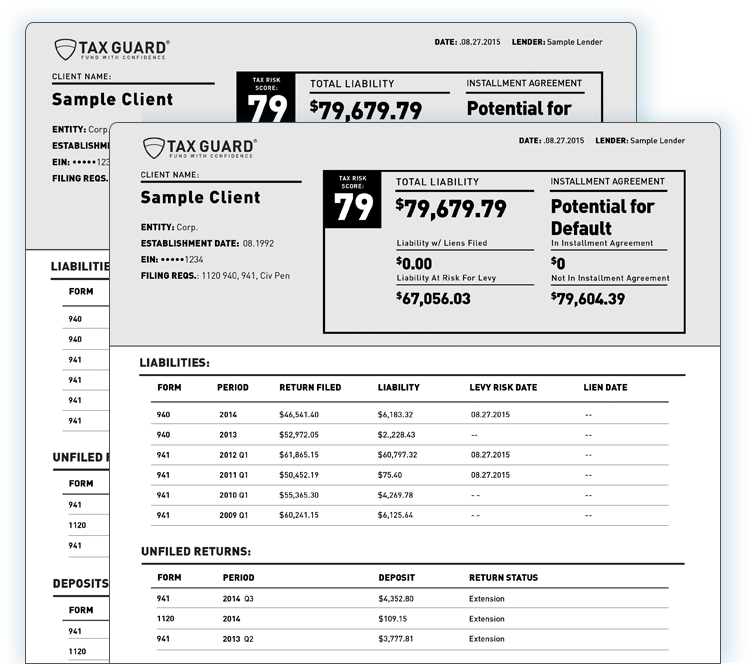

The Standard

Tax Guard reports provide 10 years of client tax compliance with outstanding liabilities, missing tax returns, tax deposit verification, and lien filings to measure your risk prior to funding.

-

Efficient

One concise report positions you to make confident credit decisions with agility on the basis of complete and reliable tax compliance data.

-

Early Insight

Identifying potential risk allows you to mitigate tax issues, cash flow problems or financial instability before the IRS takes action. Fewer surprises. More certainty.

Tax Guard Reports are available the same day, within 24 hours or within 30 days.

Same Day

Next Day

Thirty Day

Monthly Monitoring Reports

Monitor tax issues while you fund.

-

Monthly Reports

Proactive, comprehensive information sourced from the IRS on a monthly basis for each monitored client.

-

Alerting

Triggered alerts notify you when your client's account has changed with the IRS so you can preemptively manage your risks.

-

Portfolio Health

With ongoing client monitoring, we have a proven success record of preventing loss, thereby improving the overall portfolio health for lenders.

Tax Consulting services

Solve tax problems so you can fund.

When tax issues are identified, our tax experts offer transparent resolution strategies for you and your client to ensure no uncertainty or disruption occurs.

Relationship fostering and proactive tactics provide you with a clear path to client retention and profitability.

Loss prevention and protection through active management of client tax issues providing you a peace of mind throughout the life of the loan.

What our Customers Say About Us

SIGN UP FOR TAX GUARD’S NEWSLETTER

Join our community and subscribe to Tax Guard's Newsletter to receive great tax-related

content for commercial lenders delivered right to your inbox.